Why the business jet recovery is (finally) coming in 2014

Only an idiot would predict a recovery in 2014… but it is coming.

I hate to make this my main prediction for 2014, but this will be the year the business jet market starts recovering. Yes, I know this has been predicted many times before. And usually in January. But if you believe the economic forecasts – and I don’t blame you if you don’t – there is a real chance this could happen this year.

The IMF is forecasting that global GDP will grow by 3.6 per cent in 2014, up from 2.9 per cent in 2013. It is also forecasting more than 4 per cent growth for 2015, 2016 and 2017. Most significantly, a lot of this growth is expected to come from the US, the key business jet market.

There are three caveats: 1) The IMF is right (and it has often been wrong); 2) We do not get a sudden shock to recovery (and we have had lots of these); and 3) Business jet sales are linked to GDP (it makes sense that they are, but interestingly this link only became apparent after 1994).

I am not saying that the pre-owned fleet overhand will suddenly disappear or that prices will start rising. But it is worth noting that many experienced dealers have returned to buying inventory.

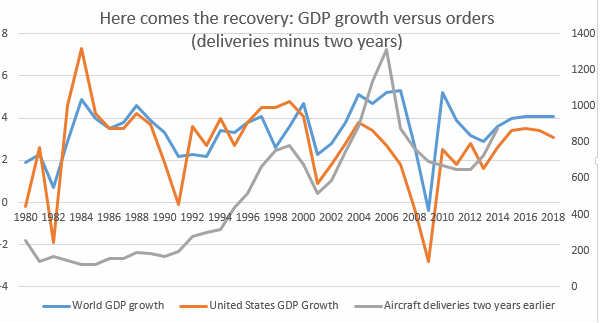

This chart (which pulls jet deliveries back two years as a proxy for orders) shows 4 per cent GDP growth is enough to sustain orders. In fact, if you use JP Morgan’s delivery forecast for 2014-2006, it suggests that the market should turn this year.

US GDP rose by 4 per cent in the last quarter and several of the small business confidence surveys are seeing improvements helped by the end of the US government shutdown. Sales of pick-up trucks (which some analysts believe are the ultimate measure of small business confidence) rose in the third quarter which could be good news for small jets. Large companies have also been sitting on cash and are showing signs of wanting to invest in 2014.

I completely understand if you disagree with me (I am not 100 per cent sure if I agree with myself), but there really is a strong chance that this will be the year the recovery starts.

Other predictions: Dassault will end 2014 with more than 100 orders for the Falcon 5X and will also launch another new aircraft; Gulfstream will launch a new large jet to replace the G450; Pilatus will also see strong demand for the PC-24 when it goes on sale at EBACE; Business jet finance is back and this will be seen by record attendance at our London conference in February, but there will still be deals (such as for charter operators), where it it will still be hard to find finance; OEMs will deliver more than 700 jets, for the first time since 2009.

As my past predictions have shown, my record as a forecaster is patchy at best, but let’s hope this year I am right.

Subscribe to our free newsletter

For more opinions from Corporate Jet Investor, subscribe to our One Minute Week newsletter.