International Corporate Jet & Helicopter Finance 2014: Live Blog – Day One

Richard Koe from WINGX Advance addresses the room

Corporate Jet Investor brings you live coverage from International Corporate Jet & Helicopter Finance 2014 in London. Make sure you refresh the page for the latest updates.

Richard Koe, managing director at WINGX Advance addresses the room at International Corporate Jet & Helicopter Finance 2014 in London.

Summary

- The first day of International Corporate Jet & Helicopter Finance 2014 focuses on the business jet market and broadly covers new aircraft sales, aircraft finance availability and the light jet market.

- Speakers include executives from Cessna, Beechcraft, Bombardier, Gulfstream and plenty more.

- For more updates, follow @CorpJetInvestor and @BizJetBlogger on Twitter.

Live blog

18.05 That’s a wrap for today. Join us tomorrow morning when we’ll hear from Wheels Up, VistaJet, Credit Suisse and more.

18.02 Bernhard Fragner, CEO of GlobeAir, says there is a need for online charter brokers, but that GlobeAir can provide the customer with more than an online booking platform. Margetson-Rushmore says the majority of London Executive Aviation’s business will still come from charter brokers in five years’ time. “Booking a flight is not like booking a hotel room,” he adds.

17.45 Margetson-Rushmore says he’s seen a “major positive change” in the past six months in terms of the number of people who are interested in buying an aircraft. David MacDonald, sales director at Hunt & Palmer, says there is now a “different buying culture” in the UK, where private aviation has became much more acceptable.

17.40 In our final panel on the light jet market, Patrick Margetson-Rushmore, chief executive of London Executive Aviation, says he’s changed from being a VLJ pessimist to an optimist in the last year.

17.10 Today’s penultimate panel looks at unfair discrimination towards high-utilisation – or high-time – aircraft. Oliver Stone, managing director of Colibri Aircraft, says: “We find that a lot of our customers – the high-net-worth individuals – are buying aircraft as a financial reward, like somebody might buy themselves a car if they’ve had a good financial year. For that reason, they’re not interested in buying a hand-me-down high-time aircraft.”

16.35 Xiaotong Tong, director of aviation finance at Minsheng Finance Leasing, was also in action on the Asian business jet panel this afternoon.

Xiaotong Tong from Minsheng Financial leasing talks through the Minsheng master-plan at #cji14 #bizav #bizjet pic.twitter.com/EOcczMQx0X

— BizJetBlogger (@BizJetBlogger) February 4, 2014

16.30 Very interesting insights from Jeffrey Lowe this afternoon. The general manager of Asian Sky Group says Greater China is slowing down, but 2013 still saw 20 per cent delivery growth year-on-year.

Jeffrey Lowe tells @CorpJetInvestor London 2014 that @Bombardier_Aero & @GulfstreamAero have 69% of #bizjet market in China #cji2014

— Dougherty Quinn (@DoughertyQuinn) February 4, 2014

16.14 Earlier this afternoon, Andy Hoy, Jetcraft’s senior vice president of EMEA aircraft sales, said he would bet his money on growth in Europe over the next couple of years. Watch the video below.

15:05 Time for another vote: 67 per cent of attendees say they think that aircraft brokers and OEMs gloss over the real cost of owning a private jet.

14:15 Back from lunch and straight into a session moderated by Aoife O’Sullivan, head of aircraft finance at Kennedys law firm, on managing the the expectations of new aircraft buyers.

13.00 Before we break for lunch, here’s a photo from Dougherty Quinn.

DQ’s Tom Maher & Stephen Dougherty at @CorpJetInvestor London Conference #BizAv market sentiment improving pic.twitter.com/DJSXXeN2Gv

— Dougherty Quinn (@DoughertyQuinn) February 4, 2014

12.59 After listening to the financiers’ panel, 56 per cent of the room vote that financiers are too cautious.

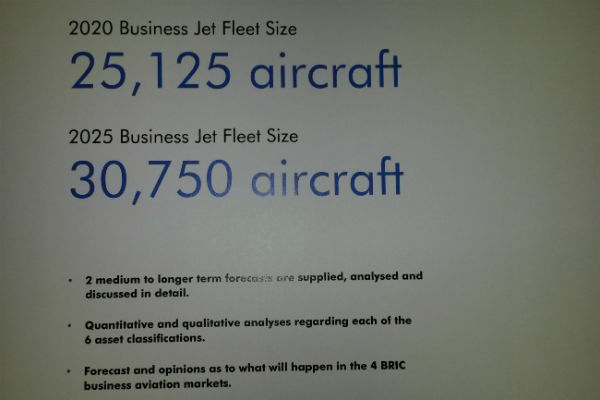

12:42 IBA Group is distributing its Business Jet Asset Report 2013 to conference delegates. The company says there will be 25,125 business jets worldwide by 2020.

10.48

#cji14 vote 3: 52% of attendees think @AlasdairWhyte knows what he’s doing

— BizJetBlogger (@BizJetBlogger) February 4, 2014

10.44 Trevor Lambarth from Bombardier says a lot of prospective buyers who are new to business aviation are attracted to the Global 7000 and 8000, as they can connect city pairs which no aircraft has been able to connect before.

10.32 Tom Perry, Cessna: “I think all the OEMS up here [on the stage] would tell you that there’s always a good time to buy and always a good time to sell. Right now, it a very good time to buy, but probably not such a good time to sell.

11.15 A new addition to the conference this year is our interactive voting system.

Second #cji14 vote of the day: 58% of attendees say that Gulfstream have the easiest job selling aircraft #bizav #bizjet

— BizJetBlogger (@BizJetBlogger) February 4, 2014

11.10 Next up, we have a panel made up of four salesmen from four business jet OEMS: Trevor Esling, Regional Senior Vice President International Sales, EMEA, Gulfstream Aerospace; Trevor Lambarth, Vice President, Sales, EMEA, Bombardier Business Aircraft; Tom Perry, Vice President, Sales – EMEA, Cessna; and Scott Plumb, Vice President, Sales – EMEA, Beechcraft.

11.03

.@Incelaw partners Stephen Marais and Andrew Charlier attending @CorpJetInvestor London conference #CJI14 #bizav #bizjet

— Ince & Co (@Incelaw) February 4, 2014

10.31

The International @CorpJetInvestor Finance Conference is today! Don’t miss Jetcraft’s Andrew Hoy at 14.15 and David Dixon at 15.40

— Jetcraft (@JetcraftCorp) February 4, 2014

10:13 With speakers predicting at least 5-7 years of business jet growth, Alasdair Whyte describes the first session as “ridiculously cheery” compared to last year.

10.05 Richard Koe, managing director at WINGX Advance, is giving some fantastic insights into European business aviation activity. Koe says there was a notable shift away from fractional jet ownership to private charter in 2013, as well as a 30 per cent increase in ultra-long-range flights from Europe. WINGX predicts a 2-3 per cent increase in flight activity in 2014 compared to 2013.

9.45 GMT The first day of the 4th International Corporate Jet & Helicopter Finance Conference is underway in London. Alasdair Whyte, editor of Corporate Jet Investor, kicked things off by telling a joke about the expensiveness of EBACE for the third time in less than a year. The room at the Royal Garden Hotel is packed from the front to the back and Rolland Vincent from JETNET is currently taking the room through the company’s business jet forecast.