Asset Insight: Good quality aircraft trading fastest

The number of business aircraft listed for sale fell by 21 aircraft in December 2014, for the 76 models covered by Asset Insight, a provider of asset evaluation and financial optimisation services.

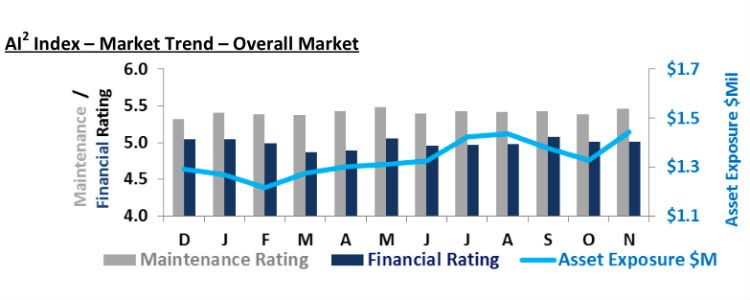

The average maintenance rating for the business aircraft inventory, which includes turboprops as well as business jets, marginally improved from the previous month. This figure suggests that the condition of aircraft for sale is improving. The asset financial rating, used to grade the cost of an aircraft’s scheduled maintenance events, remained near enough flat.

However, the asset exposure figure, which measures an aircraft’s maintenance-related financial exposure – maintenance coming due of an aircraft – worsened by nearly $115,000.

“The increase in asset exposure, in light of good maintenance and financial ratings, signifies that quality assets are the ones trading,” according to Tony Kioussis, president of Asset Insight. “Savvy buyers know to use an aircraft’s maintenance condition as a primary asset value guide, especially during today’s depressed pricing environment.”

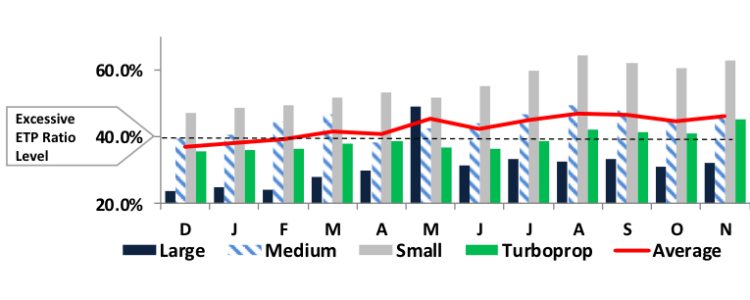

This had the adverse effect of causing the asset exposure to price ratio – known as the ETP ratio –to continue its upward curve to reach 46.3 per cent, which was the second highest monthly figure over the course of the year.

As the ETP ratio decreases, an aircraft’s value – determined primarily by its ask price – increases. An ETP of 46.3 per cent is worrying for the industry, as Asset Insight considers anything higher than 40 per cent as excessive.

Last month, the average asking price for aircraft actually improved slightly, but this was attributed to the dominance of medium jets, which was the only weight class to see asking prices improve.

The large jet market saw the lowest ETP ratio – around 30 per cent – across all groups and was the only weight class to be recognised for offering ‘outstanding’ quality.

Medium jets offered ‘excellent’ asset quality, seeing a 12-month high for asking prices, but an ETP ratio above 40 per cent.

Small jets had the worst ETP ratio amongst all weight classes and last month saw asking prices fall to a year low. However, the fleet was still deemed as offering ‘very good’ asset quality.